What Actually Worked in DTC SEO in 2025

And What We’re Watching for in 2026

Google Shopping

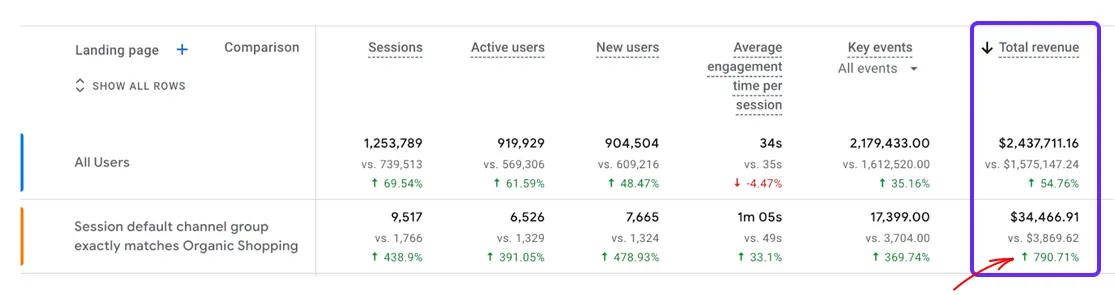

A client received 790% increase in Google Shopping revenue

Category Architecture

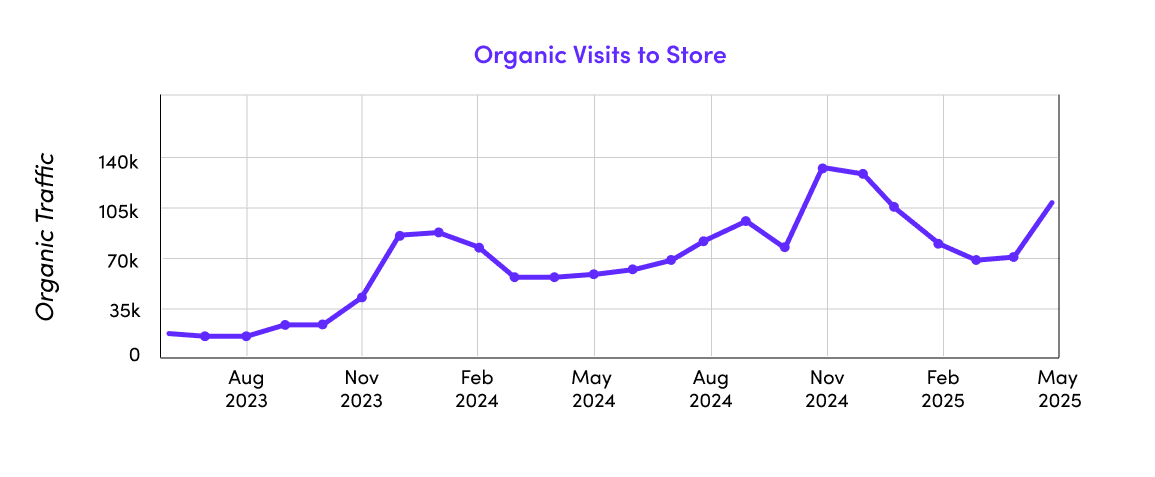

Collection expansion doubled a client’s organic revenue

Platform Expertise

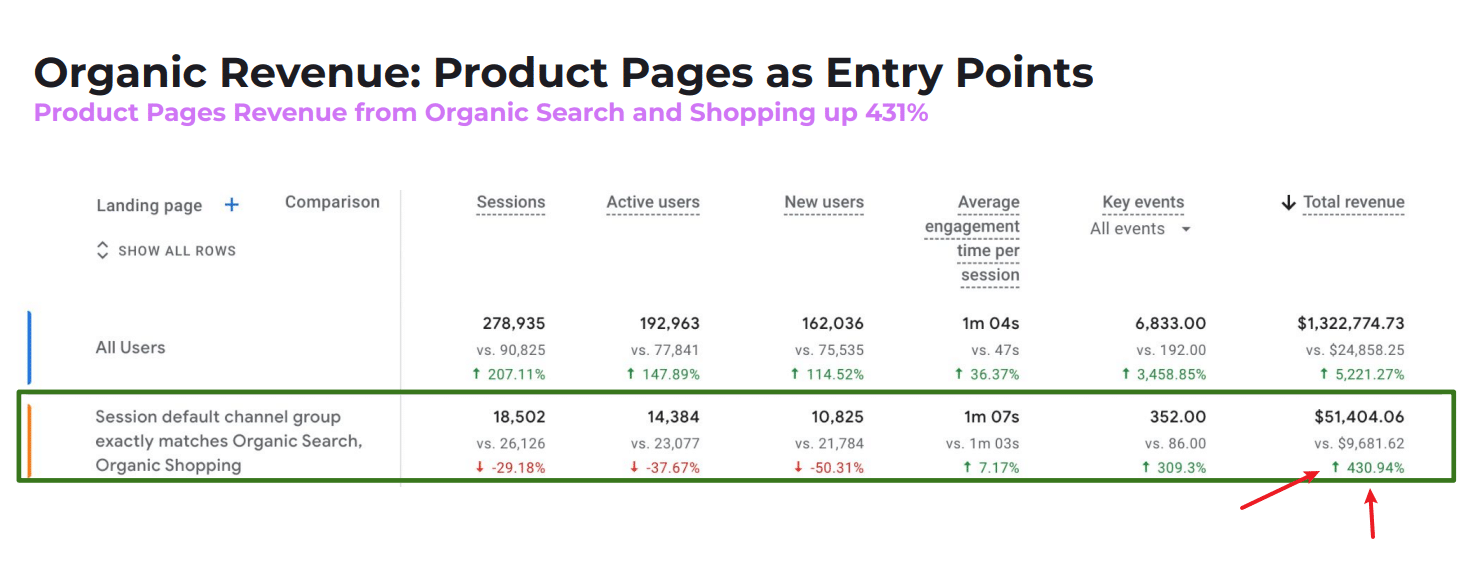

A Shopify Plus client grew product page organic revenue 431% YoY.

It was a strange year to be in SEO.

The economy was shaky, to say the least. Tariffs caused pricing confusion while consumer confidence shifted month to month. For a solid stretch in the middle of the year, most of our clients — and honestly, our own team — were just trying to find stable footing.

At the same time, the industry was having its own identity crisis. AI search went from emerging trend to existential threat (depending on who you asked), and LinkedIn filled up with agencies rebranding overnight as “GEO specialists” and thought leaders declaring traditional SEO dead.

The reality was messier — and more interesting — than either extreme.

AI-driven search is real. It’s growing. For some of our clients, it’s already a measurable source of revenue. Dismissing it would be shortsighted.

But the agencies that panic-pivoted to AI, and in the process abandoned the fundamentals to chase a trend they didn’t fully understand, aren’t better positioned today. They’re just less good at both.

Here’s What 2025 Looked Like for Our Clients

What Actually Drove Revenue in 2025

There were a lot of new things to chase this year, but the biggest wins actually came from going deeper on what already works — and what most brands still underinvest in.

Google Shopping Optimization

One client grew 790% in Google Shopping revenue by fixing data quality issues their previous agency had ignored.

We saw these patterns a lot:

- Shopify’s default feed setup leaves money on the table.

- Generic product titles work fine on your site, but they don’t work in Shopping results.

- Missing attributes (color, material, pattern) disqualify apparel products from free listings entirely.

- Poor taxonomy means Google can’t surface your products in the right searches.

The work involves rebuilding feed infrastructure, fixing data architecture, and systematic testing. Not glamorous, but it scales.

Google Shopping traffic converts at 2-3x the rate of traditional organic, yet most brands still treat their feeds as an afterthought.

Here’s a detailed breakdown of how we approach Shopping feed optimization.

Category Architecture

A sleepwear brand doubled its organic revenue in one quarter by expanding its collection structure.

Here’s how:

- We identified 12 new high-intent collections based on keyword gaps and search behavior.

- Then we reorganized 3,000+ products into logical hierarchies designed to rank.

The results:

- 6,000 new keywords were added to its footprint.

- Organic visibility increased 190%.

- Revenue per organic user jumped 122%.

Most brands think about collections as merchandising: a way to organize inventory for customers already on the site. That misses the SEO opportunity entirely.

The winning move is building collection pages around how people search, not how you think about your catalog. Map keyword demand to collection gaps and build taxonomies that compound authority across related product sets.

Here’s our framework for ecommerce SEO architecture

Collection pages capture purchase-intent traffic better than blog posts. They convert better. And unlike content that decays, well-structured taxonomies build value over time.

Technical Depth on Platforms

A consumer electronics brand on Shopify Plus grew organic revenue from product pages 431% year-over-year. It added 2,659 new ranking keywords in one quarter.

The work certainly wasn’t revolutionary. We optimized product titles to match search behavior, refined descriptions with technical specs customers actually search for, and rebuilt internal linking logic across 185 product pages.

But doing this at scale, across thousands of SKUs with complex technical specifications, requires platform expertise most agencies don’t have.

Shopify Plus has specific constraints around URL structure, schema implementation, and how product variants get indexed. Generic SEO playbooks miss these entirely.

Read our deep dive into Shopify Ecommerce SEO.

The brands winning in competitive categories understand their platform’s quirks and build optimization workflows around them.

Again, it’s not that glamorous: structured data audits, canonical tag logic, feed sync architecture, internal linking at scale. But it’s where competitive advantages come from when you’re managing catalogs with hundreds or thousands of products.

Platform expertise compounds. The first project takes longer to optimize, while the fifteenth takes half the time because you know exactly which levers to pull.

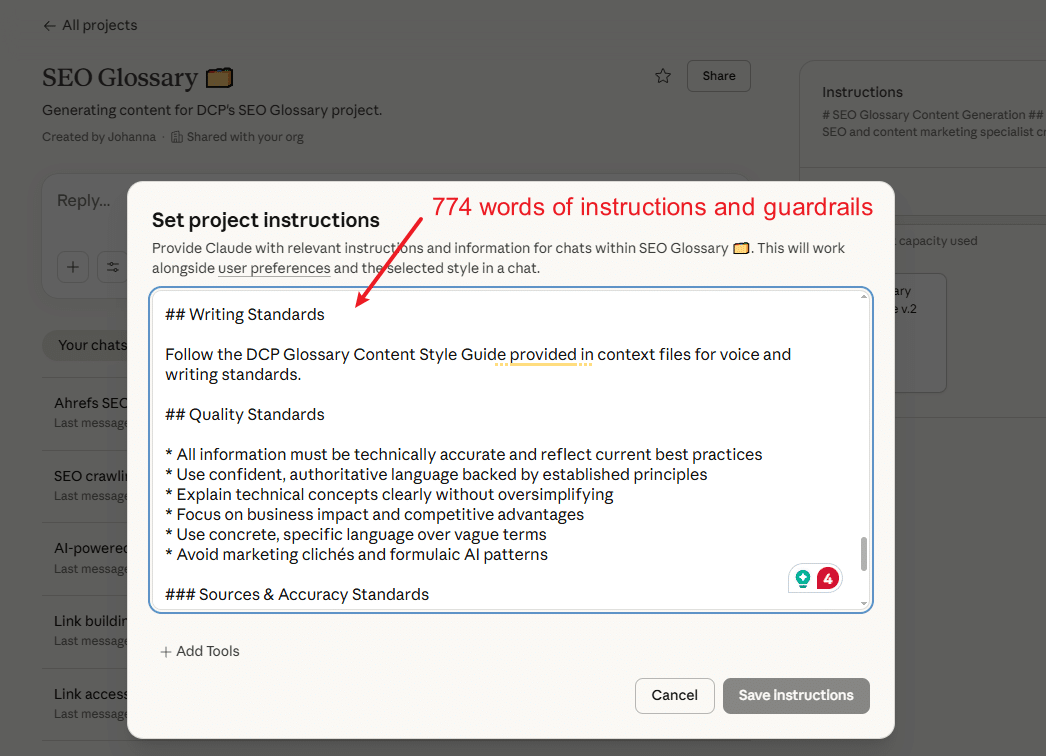

How We Used AI to 20x Our Content Output

A year ago, we could produce around 50 optimized product pages per month. Today, we’re producing 250+ per week — with tighter QC than before. Here’s how.

Our content team spent 2025 hyper-focused on one question: How do we use AI to improve efficiency without sacrificing content quality?

The answer turned out to be better infrastructure.

We now build style guides specifically designed to work as AI context — not just human reference docs. Our content team designs, tests, and iterates until AI output is consistent, predictable, and constrained in the right ways.

From there, every draft is scrutinized and refined, layering in the nuance, judgment, and brand sensibility AI still can’t replicate.

The style guides are crucial, but the real win has been the workflows built around them.

For high-volume product and category pages, we’ve developed execution frameworks that:

Map product attributes and SEO requirements to specific page elements in a defined output format.

Limit AI’s source material to approved inputs, data files, and internal linking rules.

Run one product per chat rather than batching, a deliberate tradeoff of speed for quality output.

Include self-verification steps where AI checks its own output against style, structure, and factual constraints.

That infrastructure allows us to scale production without sacrificing accuracy or brand consistency.

It’s also worth being clear about what this approach is — and isn’t. This is how we scale structured ecommerce content where consistency, coverage, and speed matter most.

Longer-form editorial work follows a different model. We still use AI and style guides to enforce consistency and improve quality, but the writing and editing remain human-led, with AI acting as an assistive layer rather than the engine.

The AI-Search Reality Check

Let’s be clear: we’re bullish on AI-driven search.

We’ve invested significant time understanding how LLMs surface brands, how citation patterns work, and what actually influences visibility in tools like ChatGPT, Perplexity, and Google’s AI Overviews.

For some clients, we’re already measuring revenue from these channels.

But here’s what we’re not doing: pretending it’s replaced Google, or that “GEO” is a magic lever that deserves more attention than the channels driving 95%+ of organic revenue today.

To find the balance, we optimize for both, measure what works, and don’t let the buzz dictate strategy.

Wondering how to win in 2026? Don’t pick a side. Build visibility everywhere customers search — without abandoning the fundamentals that actually pay the bills.

What We’re Watching for in 2026

A few predictions, based on what we’re already seeing:

AI Search Visibility Compounds for Early Movers

We’re already seeing this with clients who built AI search presence alongside their traditional SEO, not instead of it. They’re showing up in ChatGPT and Perplexity results while maintaining the Shopping feeds and category architecture that drive most of their revenue.

Success starts to feed itself. When your brand gets cited in AI-generated answers, you build authority that feeds back into traditional rankings. When you rank well traditionally, you create the content foundation AI models reference.

This is why it’s important to take a neutral approach and avoid picking a side. If you dismiss AI search completely or abandon fundamentals to chase it, you’re leaving money on the table.

Platform Expertise as Competitive Moat

The constraints and opportunities of Shopify Plus and custom builds are fundamentally different. How product variants get indexed, how URL structures scale, how schema gets implemented at the template level — these details are important when you’re managing thousands of SKUs.

Generic SEO tactics don’t translate. The work that drove 431% revenue growth for our electronics client required understanding Shopify Plus at a level most generalists just can’t reach.

Platform expertise is becoming the competitive moat for DTC brands. Winning brands prioritize working with teams fluent in platform architecture, as well as SEO theory.

Shopping Feed Optimization as Its Own Discipline

The performance gap is too wide to ignore. Brands treating Shopping feeds as an afterthought are getting crushed by brands treating them as a revenue channel.

We’re investing heavily here — the ROI is undeniable. The 790% revenue growth we saw from one client’s feed optimization isn’t an outlier. It’s what happens when you stop treating feeds as a low priority.

What We’re Building Toward

This year rewarded brands that stayed focused. The agencies that doubled down on fundamentals while staying strategically curious about AI are the ones positioned to win in 2026.

That’s the approach we’re taking into next year: Traditional ecommerce SEO that compounds, AI search optimization that builds future visibility, and the technical depth to execute on platforms where the details matter.

The brands winning next year won’t be the ones with the biggest content budgets or the most aggressive paid spend. They’ll be the ones that built visibility everywhere their customers search — and did it without abandoning the fundamentals that keep the engine running.

If you’re ready to reduce your dependence on paid acquisition and build organic revenue that compounds, let’s talk about your SEO strategy.